Blockchain technology is a new technology and is suitable for all industries and investment risk analysis is no exception. Neironix was born to meet this new investment trend.

What is Neironix?

Neironix is the first independent international credit rating agency to assess investment risk in a block-chain economy that automatically assigns assessments to projects based on mathematical scoring results, neural networks and multidimensional analysis of large amounts of data. This platform is designed to analyze and manage project-specific risks by investing in projects with high uncertainty.

Neironix can aggregate and classify aggregated information as a global integrator of financial analysis of the cryptographic currency market as a risk factor interpreted for the use of scoring for ICO and block-chain projects. The

advantage is that Neironix is unique.

Historical Record

Transparency The

Neironix

team's creativity as a final product Neironix supplies the

development

time of the encrypted currency market standard

Online data analysis

online trace

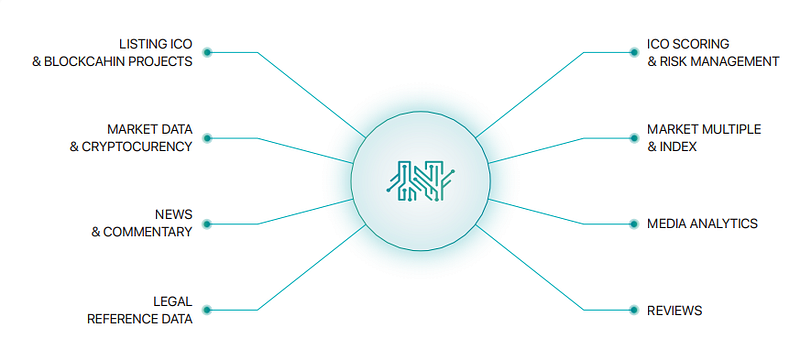

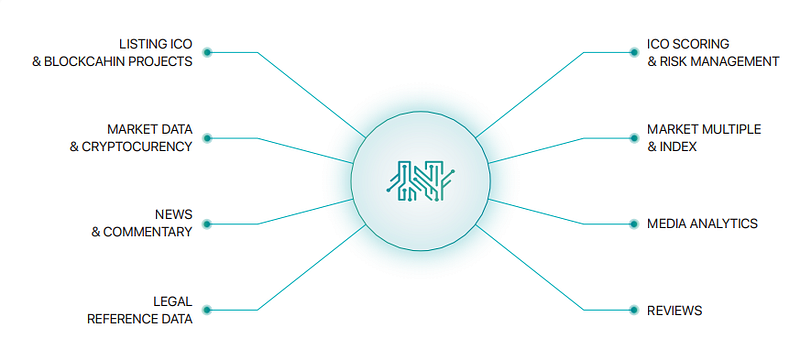

Neironix ecosystem includes:

Neironix provides the content flow and information needed to select investment ICO projects I will. Neironix objects are ICO projects as well as individual and professional investors.

Neironix

final assessment for individual investors, multi-dimensional evaluation of ICO projects;

Monitoring and notifying changes to specific ICO project assessments;

Implementation of core roadmap obligations for each ICO project implemented.

Analysis of existing and social media reports on each implemented ICO project.

Popular index for cryptocurrencies and tokens;

Financial market analysis

Modified reporting system access to supervision of financial analysis

Neironix

final evaluation results for professional investors, multi-dimensional assessment of ICO project;

Dynamic tracking of risks and their impact on outcome grades;

A flexible system for monitoring and reporting deviations from an acceptable level of risk with respect to a particular ICO project;

Implementation of core roadmap obligations for each ICO project implemented.

Structured analysis of capital for each ICO project at the token disposal stage;

Structured analysis of key token holders for

each implemented ICO project. Report recognition analysis of existing and social media for each implemented ICO project.

Monitor pumps and dumps for each ICO project implemented.

Monitors schedules for calendar and actual token lists.

Popular index for cryptocurrencies and tokens;

Exponent and magnification;

Historical data and analysis of financial markets;

Market reporting and analysis;

Traditional and social media analysis The benefits of

structured data for professional judgment

make Neironix stand out.

Historical record

information Transparency The

Neironix

team's originality as a final product Neryptix

develops standards for the cryptocurrency market

Time progress On-

line data analysis

Online tracking The

Neironix ecosystem includes:

Neironix provides content and information needed to select ICO projects for investment Provide the flow of. The goal of Neironix is ICO projects as well as individual and professional investors.

Neironix

final evaluation results for individual investors, multi-dimensional scores of ICO projects;

Monitoring for and reporting on changes in specific ICO project ratings

; monitoring emissions of core road guidance obligations for each ICO project;

Analysis of existing and social media reports on each implemented ICO project.

Popular index for cryptocurrencies and tokens;

Financial market analysis

Access to reconciliation notification systems that are responsible for financial analysis monitoring

Neironix

final assessment for professional investors, multi-dimensional scores of ICO projects;

Dynamic tracking of risk factors and extent of impact on outcome grades;

A flexible system of monitoring and notification of deviations from acceptable risk levels in relation to specific ICO projects;

Monitoring emissions of core road guidance obligations for each implemented ICO project;

Analysis of the capital structure of each ICO project at the Token Sale stage. Structural analysis of

key token holders for

each implemented ICO project. Cognitive analysis of existing and social media for each implemented ICO project.

Potential pump and dump monitoring for each enforced ICO project;

Plan and schedule monitoring for actual token listings;

Popular index for cryptocurrencies and tokens;

Exponent and magnification;

Historical data and analysis for financial markets;

Market review and analysis;

Traditional and social media analysis

Structured data

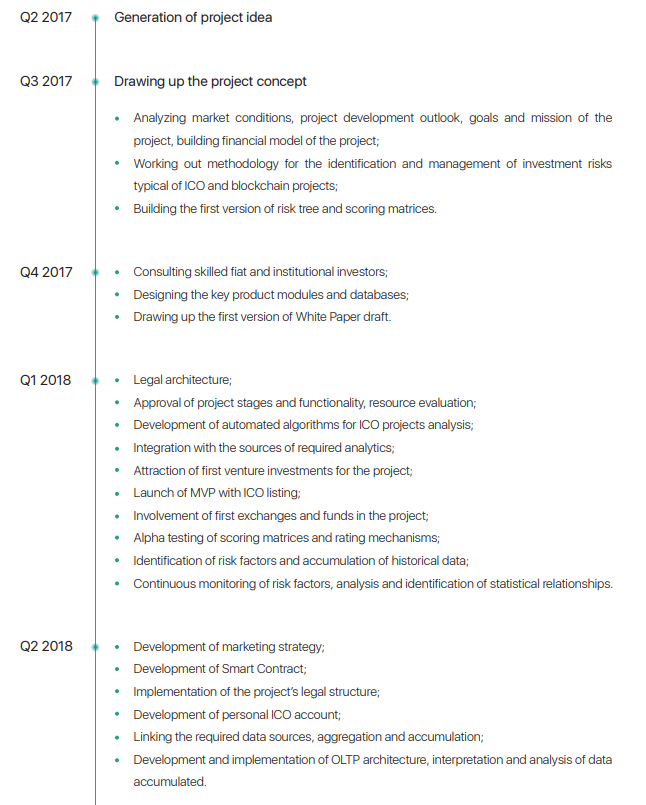

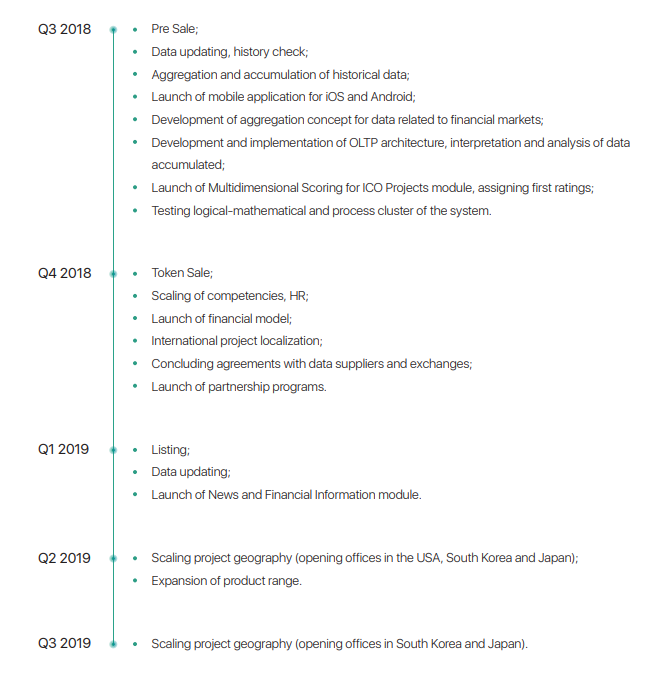

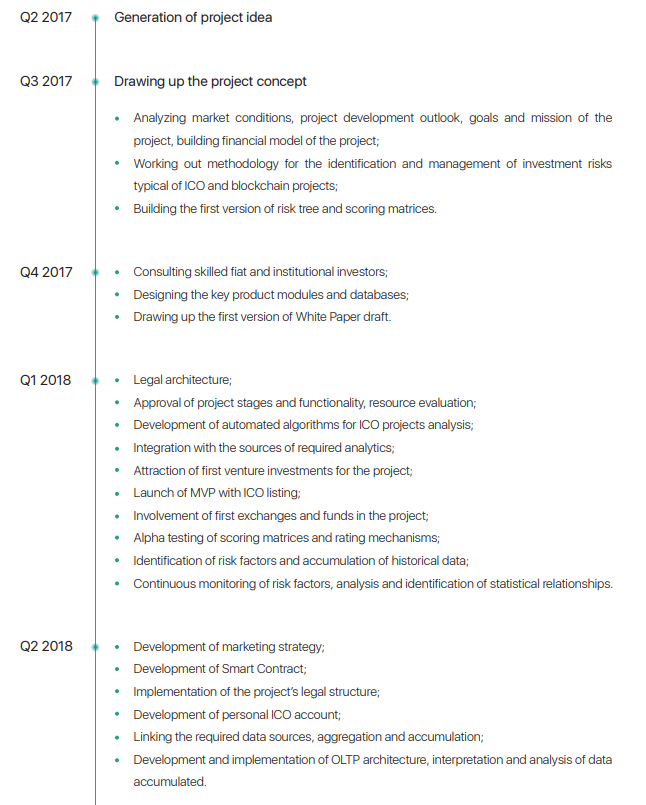

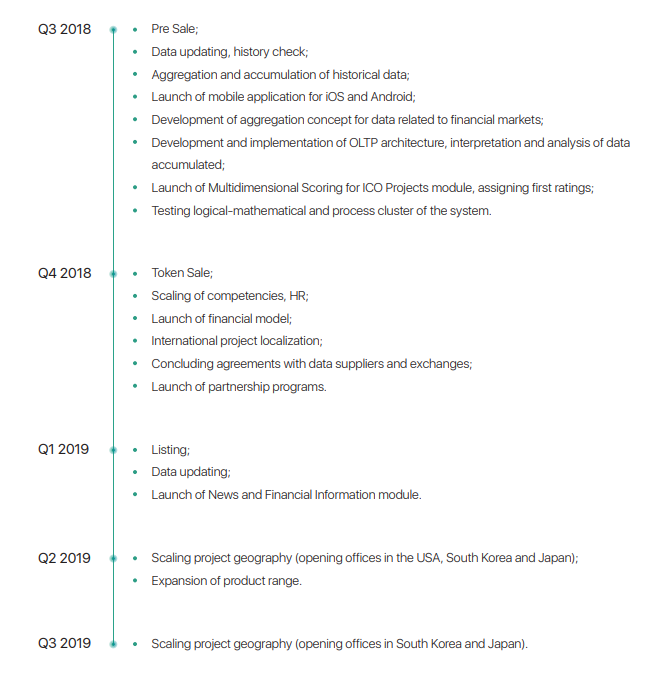

roadmap

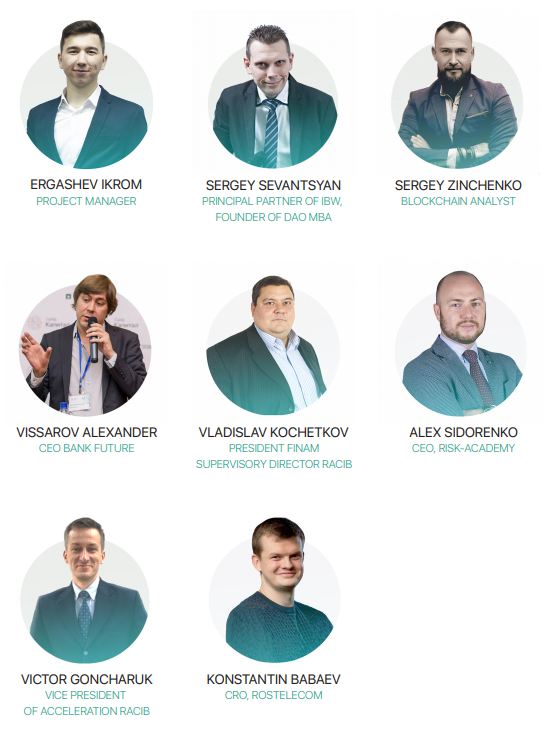

team for professional judgment

team for professional judgment

Torture

Torture

What is Neironix?

Neironix is the first independent international credit rating agency to assess investment risk in a block-chain economy that automatically assigns assessments to projects based on mathematical scoring results, neural networks and multidimensional analysis of large amounts of data. This platform is designed to analyze and manage project-specific risks by investing in projects with high uncertainty.

Neironix can aggregate and classify aggregated information as a global integrator of financial analysis of the cryptographic currency market as a risk factor interpreted for the use of scoring for ICO and block-chain projects. The

advantage is that Neironix is unique.

Historical Record

Transparency The

Neironix

team's creativity as a final product Neironix supplies the

development

time of the encrypted currency market standard

Online data analysis

online trace

Neironix ecosystem includes:

Neironix provides the content flow and information needed to select investment ICO projects I will. Neironix objects are ICO projects as well as individual and professional investors.

Neironix

final assessment for individual investors, multi-dimensional evaluation of ICO projects;

Monitoring and notifying changes to specific ICO project assessments;

Implementation of core roadmap obligations for each ICO project implemented.

Analysis of existing and social media reports on each implemented ICO project.

Popular index for cryptocurrencies and tokens;

Financial market analysis

Modified reporting system access to supervision of financial analysis

Neironix

final evaluation results for professional investors, multi-dimensional assessment of ICO project;

Dynamic tracking of risks and their impact on outcome grades;

A flexible system for monitoring and reporting deviations from an acceptable level of risk with respect to a particular ICO project;

Implementation of core roadmap obligations for each ICO project implemented.

Structured analysis of capital for each ICO project at the token disposal stage;

Structured analysis of key token holders for

each implemented ICO project. Report recognition analysis of existing and social media for each implemented ICO project.

Monitor pumps and dumps for each ICO project implemented.

Monitors schedules for calendar and actual token lists.

Popular index for cryptocurrencies and tokens;

Exponent and magnification;

Historical data and analysis of financial markets;

Market reporting and analysis;

Traditional and social media analysis The benefits of

structured data for professional judgment

make Neironix stand out.

Historical record

information Transparency The

Neironix

team's originality as a final product Neryptix

develops standards for the cryptocurrency market

Time progress On-

line data analysis

Online tracking The

Neironix ecosystem includes:

Neironix provides content and information needed to select ICO projects for investment Provide the flow of. The goal of Neironix is ICO projects as well as individual and professional investors.

Neironix

final evaluation results for individual investors, multi-dimensional scores of ICO projects;

Monitoring for and reporting on changes in specific ICO project ratings

; monitoring emissions of core road guidance obligations for each ICO project;

Analysis of existing and social media reports on each implemented ICO project.

Popular index for cryptocurrencies and tokens;

Financial market analysis

Access to reconciliation notification systems that are responsible for financial analysis monitoring

Neironix

final assessment for professional investors, multi-dimensional scores of ICO projects;

Dynamic tracking of risk factors and extent of impact on outcome grades;

A flexible system of monitoring and notification of deviations from acceptable risk levels in relation to specific ICO projects;

Monitoring emissions of core road guidance obligations for each implemented ICO project;

Analysis of the capital structure of each ICO project at the Token Sale stage. Structural analysis of

key token holders for

each implemented ICO project. Cognitive analysis of existing and social media for each implemented ICO project.

Potential pump and dump monitoring for each enforced ICO project;

Plan and schedule monitoring for actual token listings;

Popular index for cryptocurrencies and tokens;

Exponent and magnification;

Historical data and analysis for financial markets;

Market review and analysis;

Traditional and social media analysis

Structured data

roadmap

for more token information follow link bellow: