What is Xera?

XERA challenges traders facing with cryptocurrency exchange platforms

while providing an integrated solution for traders and investors who are

interested in the cryptocurrency market. XERA will provide the

professional tools and resources that traders require for precise trade

execution. XERA is currently establishing partnerships with

professionals from various industries to assist in the development of a

robust trading platform.

Liquidity Improving liquidity on crypto trading platforms is one way to

encourage mainstream adoption. To make it one of the priority solutions,

we will dedicate 10% share from profit generated from trading fee and

put that in a reserve liquidity pool. This will ensure that liquidity

remains healthy all the time.

Highly Secure Xera experienced security team is backed by a rigorous set

of audits and the latest innovations in cybersecurity. Not only are we

committed to handling your crypto and fiat, but also ensure that

personally identifiable information (PII) should be completely secure

from theft and unapproved accessibility

Lightning Fast Our exchange is going to be on one of the fastest engines

with super low latency. Have a look at our POC system in the “ALPHA

TESTING” section. We were able to sustain a 2.5 Mtps throughput and

super low latency and will keep on working to enhance it and create an

HFT (High-performance trading) system with increased scalability

Auto-trading Xera exchange allows traders to implement their trading

strategies via direct coding methods which will automatically execute

their trades based on user implemented logic. Users will have access to

all market data and technical indicators via the scripting language, so

traders can quickly implement and auto-execute their favorite trading

strategies

Existing problems And Solution in XERA ecosystem

○ Limited order types

XERA's multiple order types will provide a high level of flexibility for traders

○ Lack of auto-trading tools, unlike traditional platforms

XERA will have highly customized toolset, which can be configured for various indicators and auto-execute pre-configured orders

○ Liquidity issues

XERA will have a liquidity reserve pool that mitigates liquidity issues.

We will dedicate 10% of profit generated from trading fees to keep this

pool healthy

○ Poor customer service

We provide 24x7 support with dedicated agents who have verified expertise in their respective fields

○ Lengthy validation process for KYC approval

We have partnered with Authenteq for a 90 seconds KYC process

○ Lack of regulated crypto-fiat exchange

We are currently in the process of obtaining the required crypto trading licenses

○ Poor or no audit process

We will be engaging a third party audit agency to perform regular audits and publish relevant and accurate results

○ Slow engine and high latency

We already have POC engine developed with a recent test resulting in

2.5Mtps. High throughput and super-low latency means orders can be

executed faster

○ Security issues followed by hacks and theft

We have a team of security professionals and a dedicated budget for the

most current security tools and procedures within the industry

Backend Engine and Latency test

Backend Engine

Trade execution speed plays a vital role in determining whether your

trades are likely to yield good results or not. Today, execution speed

and accuracy remain critical to maintaining a true edge in trading. In

the crypto world, we are still far away from a trading engine with a

speed of traditional trading platforms. Xera was able to achieve 2.5

MTPS (Million transactions per second) in our test lab on our POC

systems. The video shows our backend engine performance test. Our team

is going to constantly enhance the performance as we progress.

Latency test

Latency means a delay or lapse of time between a request and a response.

Higher latency means a larger delay for a trader to interact with the

market and that results in price fluctuation and thus orders not getting

fulfilled as expected. For active traders, latency needs to be managed

to increase odds of success. Our systems are built to provide very low

latency and that too in different geographical locations. The video

shows our engines latency test.

Token Details:

The Xera token is developed on the ERC20 standard and is going to follow

the Ethereum platform. Xera token can be used by traders to reduce

their trading fees, and through our token buyback monetary policy,

continue to generate additional value for their cryptocurrency

portfolio. The token will be the native currency for XERA and will be

priced at $0.50 per token. XERA token sale will start on October 1, 2018

and conclude on November 27, 2018. Funds raised from selling 70% of the

token supply during the ICO will be used to establish the decentralized

XERA exchange that will be launched in Quarter 2, 2020.

Token Symbol

Token Protocol

|

Ethereum, ERC20

|

Token Sale Start

|

1 October 2018

|

Token Sale End

|

27 November 2018

|

Max circulating supply

|

95,000,000

|

Tokens for sale

|

65,500,000

|

Token Price

|

0.50 USD

|

Payment methods

|

ETH

|

Softcap

|

5,320,000 USD

|

Hardcap

|

29,260,000 USD

|

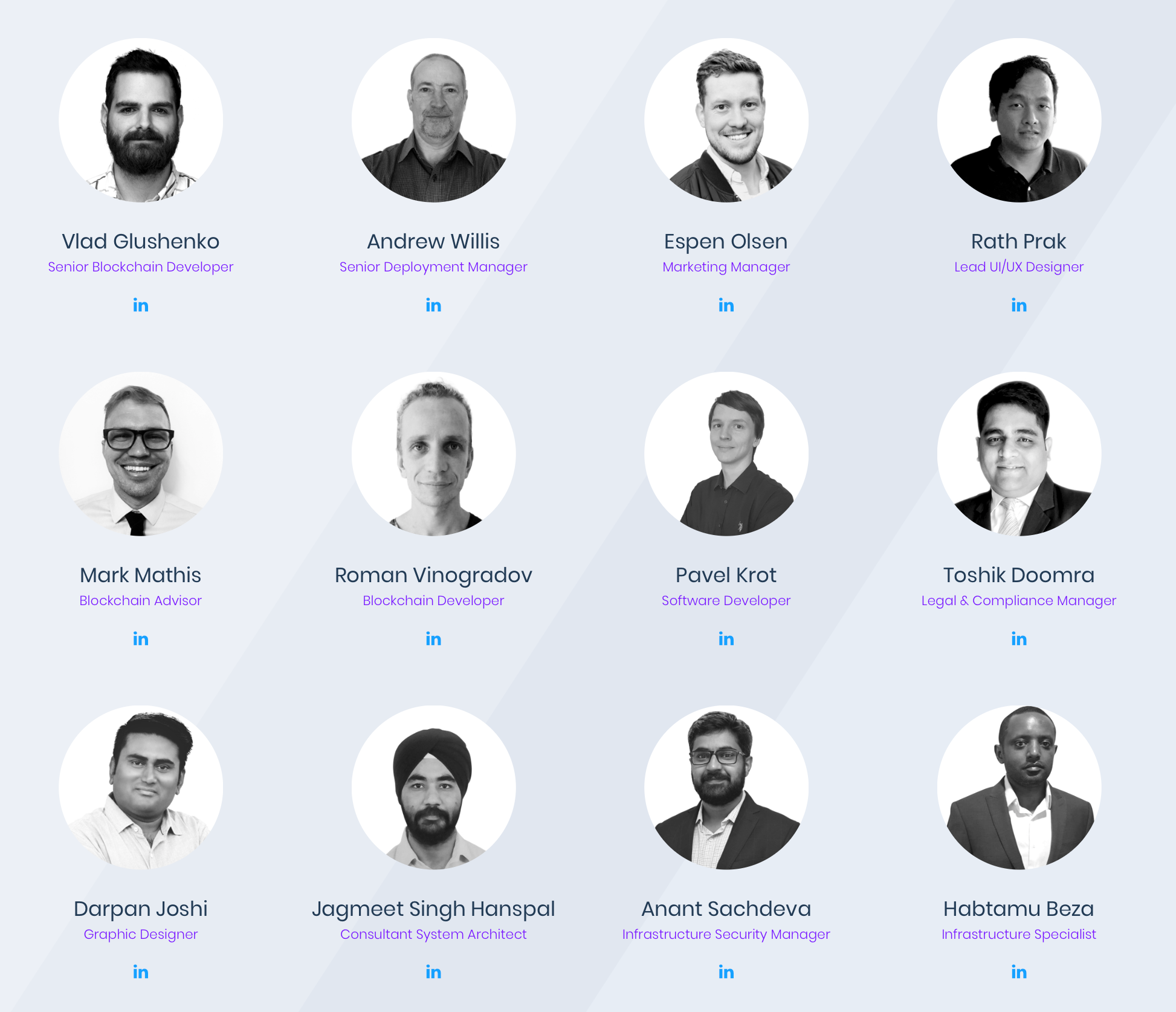

Project Team:

The XERA team is comprised of traders who have gained decades of

experience in the banking and information technology sectors. As such,

we have identified the functions that should be non-negotiable in a

quality cryptocurrency exchange. Many traders currently have to use

third-party and other paid tools to fulfill their full spectrum of

cryptocurrency trading requirements via exchanges. XERA will be a fully

integrated cryptocurrency trading exchange that resolves the key issues

and challenges that traders are facing with current exchanges. To fund

the development of XERA, an ICO will be launched to sell the XERA token

and provide traders with access to a platform that incorporates all of

the components that investors need at one place.

for more token information follow link bellow: